Understanding the financial statements of your organization is crucial for effective leadership and management. For nonprofit CEOs, grasping the distinction between an income statement and a balance sheet can help ensure fiscal responsibility and transparency. This guide aims to elucidate the key differences and importance of each financial document.

Income Statement

An income statement, also known as a profit and loss statement, provides a summary of an organization’s revenues and expenses over a specific period, such as a month, quarter, or year. This statement helps to determine the organization’s financial performance, showing whether it made a profit or incurred a loss during the period.

Components of an Income Statement

- Revenue: This section includes all income generated from the organization’s activities, such as donations, grants, program fees, and other sources of revenue. It is key to recognize revenue is not the same thing as cash.

- Expenses: This section lists all costs incurred by the organization, including salaries, rent, utilities, program expenses, and other operational costs.

- Net Income: The difference between total revenue and total expenses. If revenue exceeds expenses, the organization has a net income or surplus. If expenses exceed revenue, the organization has a net loss or deficit.

Importance of the Income Statement

The income statement is essential for several reasons:

- It provides a detailed view of the organization’s financial health.

- It helps in assessing the effectiveness of programs and initiatives by comparing expenses and revenues.

- It aids in budgeting and financial planning by revealing trends in income and expenses.

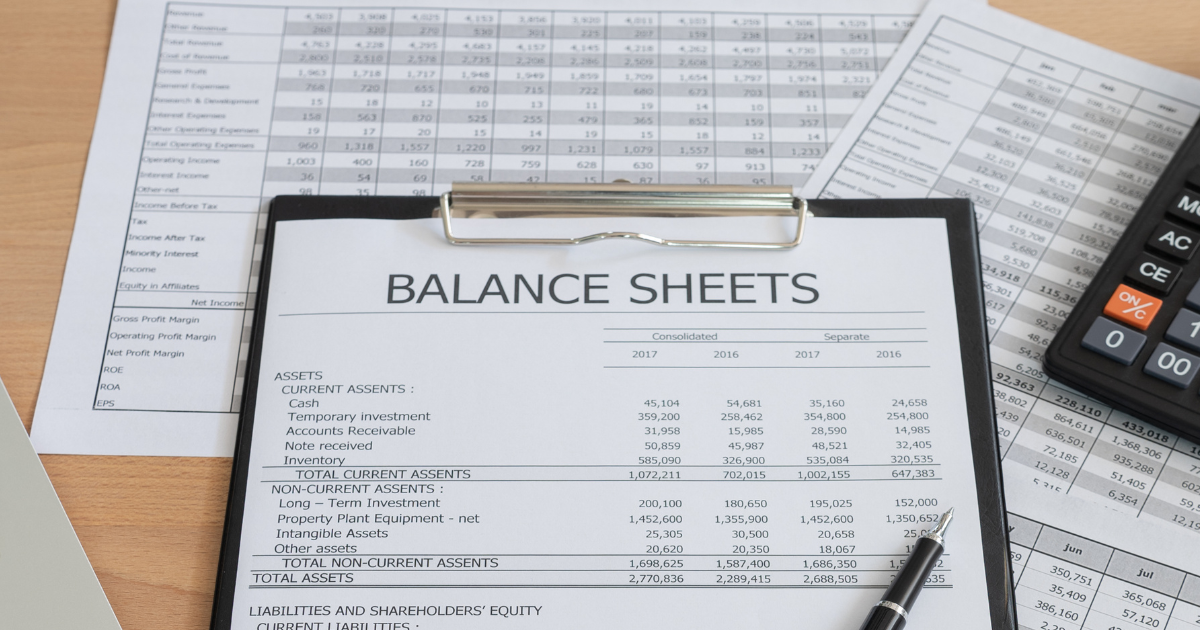

Balance Sheet

A balance sheet, also known as a statement of financial position, provides a snapshot of an organization’s financial condition at a specific point in time. It lists the organization’s assets, liabilities, and net assets.

Components of a Balance Sheet

- Assets: This section includes everything the organization owns, such as cash, investments, property, equipment, and accounts receivable.

- Liabilities: This section lists all debts and obligations, including loans, accounts payable, and other liabilities.

- Net Assets: The difference between total assets and total liabilities. For nonprofits, this section is often divided into unrestricted or restricted net assets, depending on donor-imposed restrictions.

Importance of the Balance Sheet

The balance sheet is crucial for several reasons:

- It provides a comprehensive view of the organization’s financial standing at a specific point in time.

- It helps in assessing the organization’s liquidity and ability to meet short-term and long-term obligations.

- It aids in evaluating the organization’s financial stability and sustainability by showing the relationship between assets and liabilities.

Key Differences Between an Income Statement and a Balance Sheet

- Time Frame: The income statement covers a specific period, while the balance sheet represents a snapshot at a particular point in time.

- Focus: The income statement focuses on revenues and expenses, showing the financial performance over a period. The balance sheet focuses on assets, liabilities, and net assets, showing the financial position at a point in time.

- Purpose: The income statement helps in assessing profitability and operational efficiency, while the balance sheet helps in assessing financial stability and liquidity.

Why Nonprofit Leaders Need Both Statements

For a nonprofit CEO, both the income statement and the balance sheet are indispensable tools for financial management. Together, they provide a holistic view of the organization’s financial health. The income statement helps in understanding how well the organization is managing its resources, while the balance sheet shows its capacity to sustain operations and grow in the future.

Using the Income Statement and Balance Sheet Together

By analyzing both statements, nonprofit leaders can:

- Make informed decisions about resource allocation and program funding.

- Identify areas of financial strength and vulnerability.

- Develop strategies for improving financial performance and stability.

Conclusion

Understanding the difference between an income statement and a balance sheet is crucial for effective nonprofit leadership. These financial documents provide valuable insights into the organization’s performance and position, enabling leaders to make informed decisions and ensure long-term sustainability. By mastering these tools, nonprofit CEOs can better serve their missions and communities.

Nonprofit Financial Acumen’s flagship course Navigating Nonprofit Finance: A Course for Leaders provides an in-depth understanding of nonprofit financial terminology and offers practical applications of this terminology with actual income statement and balance sheet examples. It is crucial for nonprofit leaders to possess a clear understanding of these financial statements and what they communicate about the nonprofit organization. By equipping themselves with this knowledge, leaders can effectively interpret the financial health and performance of their organizations, enabling them to make sound strategic decisions that align with their mission and goals.